iXBRL Tagging – submitting statutory accounts to National Regulators & Tax Authorities

Alui’s expertise is in the support of financial systems, and for iXBRL tagging we are proud to partner with CoreFiling, who invented iXBRL in conjunction with UK HMRC. We are able to help you meet the mandatory submission guidelines in the UK & European Union (EU)/EEA countries, by providing you with a Full Tagging Service or with licences for CoreFiling’s cloud-based Seahorse® solution to carry out your own tagging in-house.

CoreFiling’s Seahorse® Solution – carry out your own in-house tagging

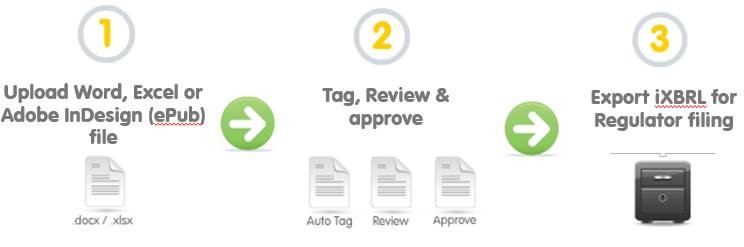

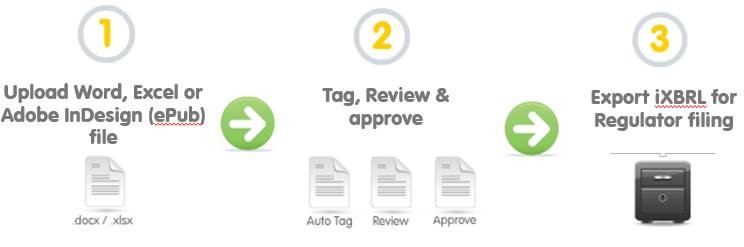

Seahorse® is a cloud-based solution that allows you to produce an iXBRL file for submission to your National Regulator/Tax Authority.

- No changes to the way you currently produce accounts

- No specific knowledge of iXBRL or XBRL required

- No software to install, run or maintain

- Takes half the time of manual ‘drag and drop’ systems

- Rapid, accurate machine learning means reduced risk of mis-tagging

- Audit trail delivers inbuilt accountability and transparency

- Fully compliant with your National Regulator/Tax Authority mandate

Alui provide full training and support at whatever stage you choose to take on the tagging in-house. You could choose to use our tagging service in the first year, this relieves you of the burden of doing all the initial tagging work yourselves. Once the document has been tagged, the second year onwards becomes even easier as Seahorse® allows you to automatically tag the second-year accounts based on the tags applied in the prior year.

Full Tagging Service

Full Tagging Service